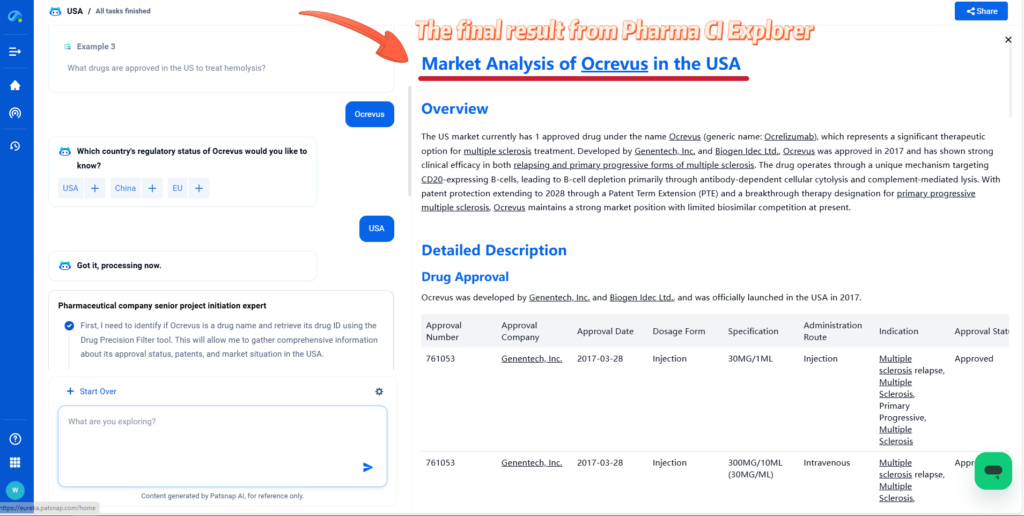

Lacosamide Market Analysis in the USA: Patent Landscape, Clinical Insights, and Strategic Entry

Overview

The US market currently has 1 approved drug containing lacosamide, marketed primarily as Vimpat by UCB. Lacosamide was first approved in 2008 and has established itself as an important anti-epileptic medication. The drug has experienced patent expirations for its original formulations, leading to generic entry, while new extended-release formulations were approved in 2023 with patent protection extending to 2040.

Detailed Description

Drug Information

Lacosamide was originally developed by UCB SA and is approved in the US for the treatment of epilepsy, particularly partial-onset seizures and tonic-clonic seizures. The drug acts as a sodium channel blocker.

Structure

Patent Statement Information

Lacosamide (Vimpat) has multiple patent statements in the US:

| Trade Name | Submission Date | Number of ANDAs | 180-day Exclusivity Status | First Applicant Approval Date |

|---|---|---|---|---|

| Vimpat | 2012-10-29 | 14 | Extinguished | 2022-03-17 |

| Vimpat | 2016-06-30 | 1 | Extinguished | 2020-03-10 |

| Vimpat | 2012-10-29 | 3 | Extinguished | 2022-04-18 |

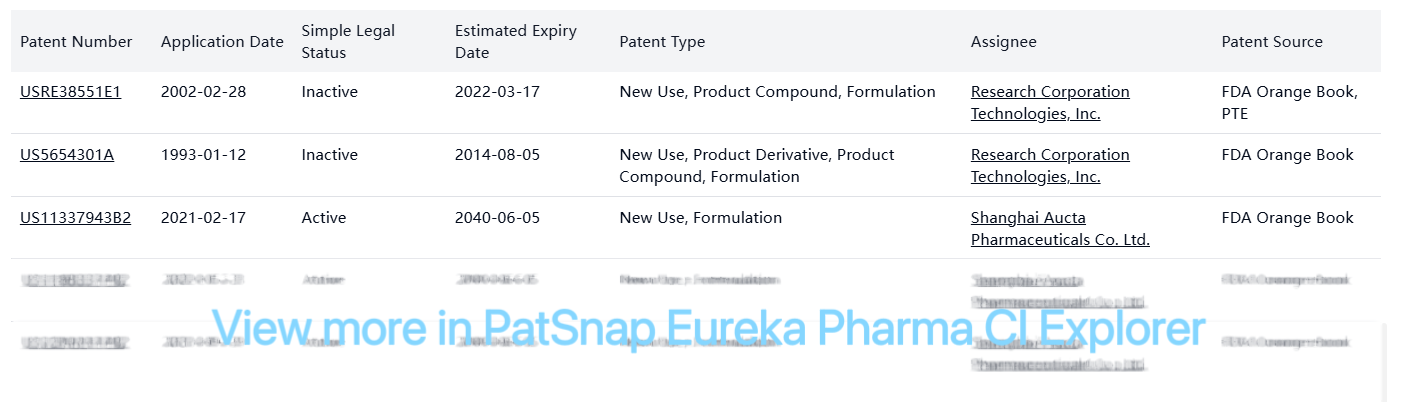

Registration Patent Barrier Analysis

The FDA Orange Book patents for lacosamide show a mix of expired and active patents, with the original compound patents now expired but newer formulation patents still active:

Other Patent Barrier Analysis

There are numerous other patents related to lacosamide held by various companies, covering different aspects such as processes, formulations, and new uses. Key examples include:

| Patent Number | Application Date | Simple Legal Status | Estimated Expiry Date | Patent Type | Assignee |

|---|---|---|---|---|---|

| US9284263B1 | 2015-03-12 | Inactive | 2035-03-12 | Process | PANDEY SATYENDRA KUMAR |

| US11278634B1 | 2021-05-21 | Active | 2041-05-21 | Process | Extrovis AG |

| US20210023013A1 | 2019-01-07 | Active | 2039-11-27 | Formulation | Whan In Pharmaceutical Co., Ltd. |

| US10414720B2 | 2017-06-12 | Inactive | 2037-06-12 | Process | Unichem Laboratories Ltd. |

| US9095557B2 | 2013-11-14 | Active | 2027-06-15 | New Use | UCB Pharma GmbH |

The patent landscape shows that while the original compound patents have expired, allowing for generic entry for the basic formulations, newer extended-release formulations by Aucta Pharmaceuticals have patent protection until 2040, creating a new exclusivity period for these specific formulations.

Clinical Results

Based on the FDA label clinical insights:

Pharmacokinetic Drug-Drug Interaction Studies:

- Lacosamide (400 mg/day) showed no influence on the pharmacokinetics of valproic acid and carbamazepine.

- When coadministered with carbamazepine, phenobarbital, or phenytoin, lacosamide plasma concentrations were reduced by approximately 15-20%.

- No significant effects were observed on the pharmacokinetics of digoxin when coadministered with lacosamide.

- No clinically relevant changes in pharmacokinetic profiles when lacosamide was coadministered with metformin.

Clinical Trials:

- Efficacy and safety were evaluated in controlled clinical trials as adjunctive therapy for patients with partial-onset seizures

- In monotherapy trials, 16% of patients receiving lacosamide at recommended doses (300-400 mg/day) discontinued due to adverse reactions, with dizziness being the most common adverse event leading to discontinuation

- Clinical trials enrolled 1,327 patients in adjunctive therapy trials and 425 patients in monotherapy trials for partial-onset seizures

Infringement Cases

No specific patent infringement cases related to lacosamide were identified.

Policy and Regulatory Risk Warning

After a comprehensive search, no specific market exclusivity or data protection periods were identified for lacosamide in the US beyond the patent protection. The original patents have expired, allowing generic competition for the immediate-release formulations, while the extended-release formulations have patent protection until 2040.

Market Entry Assessment & Recommendations

Market Entry Timing:

- Immediate-release formulations (tablets, oral solution, injectable): The key patents have expired and generic competition has already begun, as evidenced by the patent statements showing multiple ANDA approvals with first generic entry in 2022.

- Extended-release capsules: These formulations are protected until 2040, creating a significant barrier to generic entry for this specific dosage form.

Strategic Recommendations:

For generic manufacturers targeting immediate-release formulations:

- Focus on cost optimization and manufacturing efficiency to compete in a market with multiple generic entrants

- Consider differentiation through patient services, packaging innovations, or improved supply chain reliability

- Explore partnerships with pharmacy benefit managers for preferred formulary positioning

For companies interested in extended-release formulations:

- Consider challenging the validity of the Aucta Pharmaceuticals patents or developing non-infringing extended-release technologies

- Explore licensing opportunities with the patent holder

- Invest in R&D for novel delivery systems that could offer additional benefits beyond the current extended-release formulation

For the innovator (UCB):

- Focus on transitioning patients to the extended-release formulation to protect market share

- Develop additional line extensions or combination therapies to extend the product lifecycle

- Consider strategic pricing to maintain competitiveness against generics while maximizing revenue from formulations still under patent protection

Market Positioning:

- Emphasize clinical benefits specific to lacosamide's mechanism of action as a sodium channel blocker

- Target patient subpopulations where lacosamide shows particular efficacy or tolerability advantages

- Develop educational programs for healthcare providers on the appropriate use and benefits of lacosamide in epilepsy management

The lacosamide market in the US presents different opportunities depending on the specific formulation. While immediate-release forms face generic competition, the extended-release capsules represent a protected market segment until 2040, creating a dual market dynamic that requires tailored strategies for different players in this therapeutic area.

For more scientific and detailed information of lacosamide , try PatSnap Eureka Pharma CI Explorer.